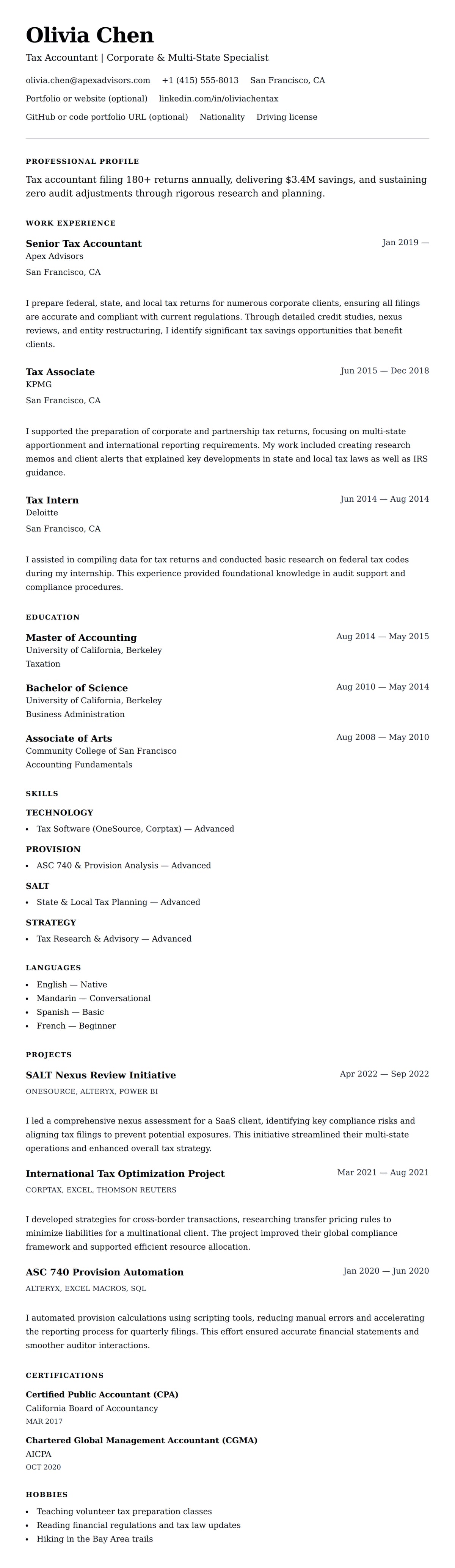

Tax Accountant Resume Example

This tax accountant resume example highlights proficiency in compliance, provision work, and strategic planning. It shows how you manage multi-entity returns, research changing regulations, and collaborate with finance leaders to minimize risk.

Metrics emphasize tax savings, audit results, and process efficiencies so CPA firms and corporate tax departments trust your impact.

Customize the example with jurisdictions, software, and industry-specific tax issues you handle.

Highlights

- Navigates complex corporate tax requirements with zero audit adjustments.

- Discovers strategic savings opportunities for clients through research.

- Automates tax processes to deliver faster, higher-quality workpapers.

Tips to adapt this example

- List tax software and data tools you master.

- Reference research memos or guidance you provided to clients or leadership.

- Include cross-functional collaboration with finance, legal, or auditors.

Keywords

More resume examples

Explore more curated examples you might find useful.

Accounts Receivable Specialist Resume Example

FinanceAccelerate cash collections with disciplined billing, proactive follow-up, and data-driven dispute resolution.

Banker Resume Example

FinanceCultivate client portfolios, structure lending solutions, and safeguard compliance while meeting aggressive growth targets.

Accounting Assistant Resume Example

FinanceProvide dependable support across AP, AR, and reporting tasks that keep controllers confident and vendors paid.

Create your professional resume in minutes

Join thousands of job seekers who have landed their dream jobs with our resume builder.